Get Control Of Your Life

Welcome to Achieve Your Dreams, the ultimate guide and resource for assisting families, seniors, retirees, migrants, and expats in the art of budgeting, money management and debt control! We will assist you get your Money and Finances under control and find your Life Purpose and find a Career that satisfies!

We are genuinely interested in you rather than your money. We offer inexpensive introductory packages and if you honestly can’t afford them, we may be able to arrange a subsidy – please use the ‘contact us’ form for a discount code. Most sessions can be conducted on Skype or Zoom.

About You

Whether you’re juggling the expenses of raising a family, planning for retirement, navigating a new country as a migrant, or settling into life as an expatriate, managing your finances effectively is key to achieving your goals and securing your future.

We provide tailored advice and strategies designed to meet the unique financial needs and challenges faced by each of these diverse groups. From creating realistic budgets and maximizing savings to understanding tax implications and optimizing investment opportunities, we’re here to empower you with the knowledge and tools needed to make informed financial decisions.

No matter where you are on your journey—whether you’re just starting out as a young family, enjoying your golden years in retirement, embarking on a new chapter in a different country, or adjusting to life as an expat—we’re committed to helping you navigate the complexities of personal finance with confidence and clarity.

Contact us to explore practical tips, expert insights, and proven strategies to help you achieve financial stability, security, and success, no matter what stage of life you’re in. Let’s embark on this journey together towards a brighter and more prosperous future.

Get ready to Achieve Your Dreams!

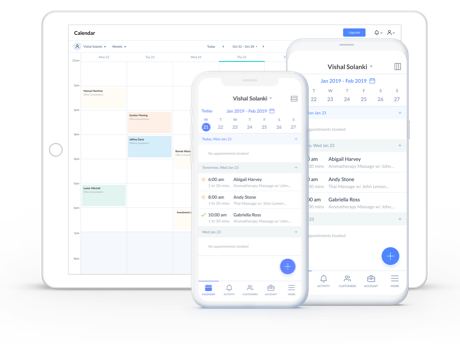

Instructions: To make an appointment

Tick box for service you require – Introductory etc.

Click on blue service – press continue at the next screen

Choose date and time

Fill out fields – Name, email and telephone – click continue

Fill out card details

Pay and you will receive an email confirming your time

What We Do for You

We use proven techniques that will assist you

We teach advanced budgeting skills which offer numerous benefits for families, seniors, retirees, migrants, and expats alike. Here’s a list highlighting some of these benefits.

- Financial Stability: Advanced budgeting helps families maintain a stable financial foundation, ensuring they can meet their day-to-day expenses while saving for future goals.

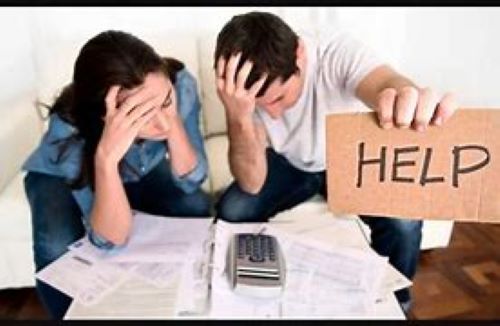

- Reduced Stress: By proactively managing finances, families can minimize financial stress and enjoy peace of mind, knowing they have a plan in place to cover expenses and emergencies.

- Improved Communication: Budgeting encourages open communication about financial goals and priorities among family members, fostering a sense of teamwork and shared responsibility.

- Teaching Responsibility: Involving children in budgeting processes teaches valuable money management skills and instills a sense of financial responsibility from a young age.

- Enhanced Quality of Life: With careful budgeting, families can allocate resources to activities and experiences that enrich their lives, such as vacations, hobbies, and educational opportunities.

- Financial Security: Advanced budgeting helps seniors and retirees maintain financial security throughout their retirement years, ensuring they have sufficient funds to cover living expenses and healthcare needs.

- Long-Term Planning: Budgeting allows seniors to plan for long-term care and unforeseen expenses, reducing the risk of financial hardship later in life.

- Maximizing Retirement Income: By carefully managing expenses and investment withdrawals, retirees can maximize their retirement income and make their savings last longer.

- Estate Planning: Budgeting facilitates estate planning by helping seniors allocate assets, minimize taxes, and ensure their wishes are carried out effectively.

- Peace of Mind: With a well-planned budget in place, seniors can enjoy retirement with peace of mind, knowing they have the financial resources to support their desired lifestyle and handle any unexpected costs.

- Financial Adaptability: Advanced budgeting helps migrants and expats adapt to new financial environments, whether it’s understanding currency exchange rates, cost of living differences, or taxation systems.

- Integration Support: Budgeting facilitates integration into a new country by helping migrants and expats understand local financial norms, expenses, and savings opportunities.

- Savings Optimization: By carefully managing expenses and taking advantage of local savings options, migrants and expats can maximize their savings potential and achieve their financial goals faster.

- Risk Management: Budgeting helps migrants and expats mitigate financial risks associated with relocation, such as fluctuating exchange rates, unexpected expenses, or changes in employment status.

- Future Planning: Advanced budgeting allows migrants and expats to plan for their future, whether it involves repatriation, permanent residency, or continued international living, ensuring they have the financial resources to support their goals and aspirations.

My Wage ATTRIBUTION: JESSIE B. RITTENHOUSE, “My Wage,” The Door of Dreams, p. 25 (1918). SUBJECTS: Life

“I bargained with Life for a penny,

And Life would pay no more,

However I begged at evening

When I counted my scanty store.

For Life is a just employer,

He gives you what you ask,

But once you have set the wages,

Why, you must bear the task.

I worked for a menial’s hire,

Only to learn, dismayed,

That any wage I had asked of Life,

Life would have willingly paid.”

We are committed to making our program affordable to everyone and so we offer 5 sessions (50 minutes per session) for $AUD50 per session, which is super inexpensive (billed as $AUD250). Even less if you can prove you can’t afford that fee – please contact us to negotiate a lower fee and receive a discount code. 5 sessions will at least start the healing process and there are more available if you need them. Homework is involved and compulsory.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

We offer a full refund guarantee but you must attend each of the 5 sessions

Stop stressing and start living – Make your appointment today

Testimonials

This is a special group for people with budgeting or money problems

and this is a link

Please join this group and share with your friends and relatives.

Money and Financial Services Coaching

Many relationships come to an end because of money issues – one or both parties can’t handle money and so frustrate each other or the relationship seems to get nowhere. I spent much of my career as an accountant and financial advisor and have training and a certificate as a Financial Counsellor. Handling money is easy once you know how. Even the largest of businesses have budgets, we call them Money Plans. Every entity has to allocate where they want the funds to come from and go to. We can assist with ways to make extra income, pay off debt, and allocate funds to special projects like holidays, saving for a home, saving to move out of home etc. Certain bills are essential – rent or mortgage, utilities, food and maybe transportation costs if you work outside your home. Once you get the idea, the rest is easy!

For immediate assistance make your appointment today!

Life Purpose and Career Coaching

We also coach those who are still struggling to find their life purpose and hence are often in misfitting jobs and positions. It can take years to find your life purpose and research also suggests it is major obstacle to happiness and job satisfaction, and causes huge frustration in those still searching.

For immediate assistance make your appointment today!

Articles

Budgeting Across Life’s Stages

In the sprawling landscape of personal finance, one principle stands as an enduring beacon of stability: budgeting. Whether you’re starting a family, embracing retirement, Read more...

Antidote to the ‘I Want’ brigade

Achieve Your Dreams, the world’s pre-eminent site for supporting and promoting men, presents another insight into assisting men to find an attractive female lifetime Read more...

To Repair a Relationship

Achieve Your Dreams, the world’s pre-eminent site for supporting men and women who have suffered a relationship loss, and promoting better relationships presents another insight into assisting men and women to find better and more satisfying Read more...